Mistakes happen in companies, I’m not saying anything. But if you don’t learn from your mistakes over a longer period of time and finally fix them, then you shouldn’t be surprised if your customers turn their backs on you.

Unfortunately, I have experienced problems and concerns again and again with my most profitable P2P* platform to date. Therefore, I have now decided to withdraw my investments.

It is a pity, because this platform has always been my highest-yielding P2P* platform. But what good are the high interest rates if you are no longer satisfied with the overall performance of the platform and even have serious concerns about whether this platform is also well equipped against a major technical failure.

We are talking about Viainvest here.

The problems on the P2P* platform started last year with the switch to asset-backed securites. This changeover meant that the account balances in the entire portal were no longer correct. Sellable loans, were suddenly no longer sellable. This function was completely removed without the investors being informed about this.

Likewise also simply the German language without advance notice was removed (that only besides).

The real problem, however, is that Viainvest takes far too long to release any information at all to investors.

I had already written an article about the problems back then, which you can read here: VIAINVEST – I’m starting to get worried.

Furthermore, I still lack accurate analysis options on the P2P* platform, for example, to see which loans are currently in default, etc..

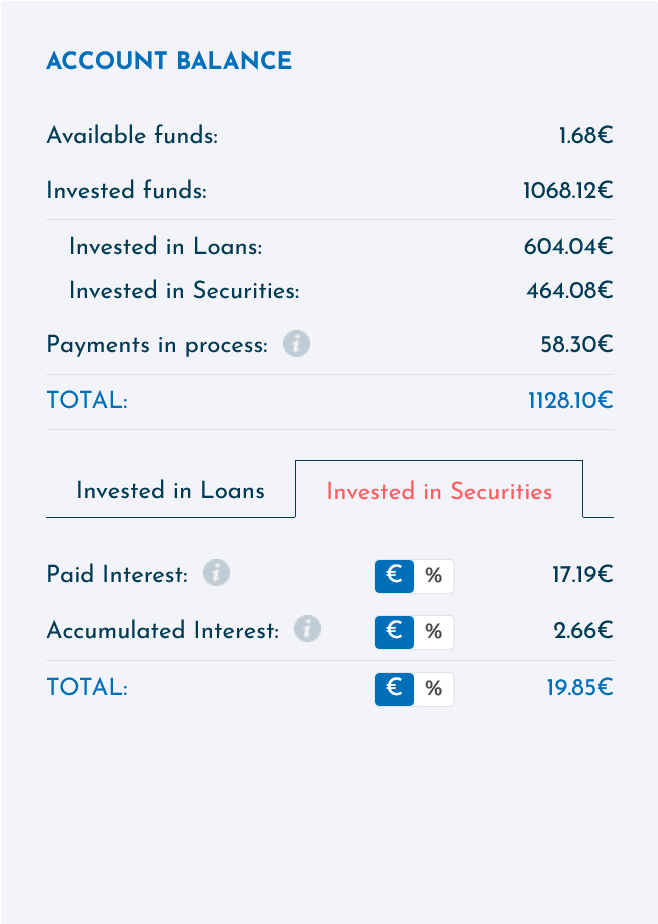

But what I find simply ridiculous is that they have not yet managed to clean up the account balances and provide investors with a proper evaluation screen.

It is not that complicated to build a frontend that can provide a monthly report via a filter. And here I mean a report that shows all key facts like received interest payments, withholding tax etc. at a glance.

One rather has the impression that Viainvest has no IT staff anymore or does not invest in IT. I have been in IT for over 13 years and had different responsibilities from simple first level support to 24×7 full service. Accordingly, I know how well you should be prepared for all IT failures.

However, with Viainvest I rather have the impression that a massive outage would paralyze the platform for several weeks and leave investors out in the cold.

And to be honest, I don’t feel like that.

April 2023 – Where have the interest payments gone?

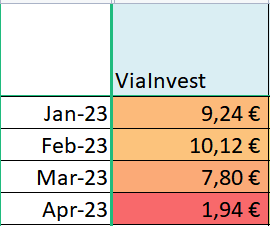

Another point that made me leave the P2P platform is that I only got 2.12% interest at Viainvest in April 2023, even though I didn’t withdraw any money here and even added another 120 EUR in the previous month.

The only other outlier in April was Mintos, but those were the failures due to the settlement of Revo’s Russian loans.

Acer Chromebook 314 (CBOA314-1H-C32M) Laptop, 14" FHD Display, Intel Celeron N4500, 4 GB RAM, 128 GB SSD, Intel UHD Graphics, Google ChromeOS, QWERTZ-Tastatur, schwarz

149,99 € (as of 2. July 2025 11:01 GMT +02:00 - More infoProduct prices and availability are accurate as of the date/time indicated and are subject to change. Any price and availability information displayed on [relevant Amazon Site(s), as applicable] at the time of purchase will apply to the purchase of this product.)Normally, I always average between 7 and 9 EUR in my investment. In April, there was only 1.94 EUR. But why?

That is exactly the big question now. Due to the lack of evaluation options and the continuing problems with the values in the account balance, I have no way of finding out what is going wrong. Are credits delayed or defaulted?

Also, once again, the export of account transactions is not working.

For me, these are all warning signals that Viainvest either deliberately overlooks or is unable to fix in the first place. Yield or not, this is not the way to go on. Therefore, I have made the decision to stop my AutoInvest and withdraw the money.

I am very sorry to say goodbye to Viainvest, but I think it is the right decision to make my investment portfolio successful in the long run.

What do you guys think about all this?

As always, I welcome your comments.

Leave a Reply